The UAE launch of a pension scheme being implemented by the Indian Ministry of Overseas Affairs was delayed due to certain technical reasons,

Now the [Indian] ministry has engaged two Indian banks — Bank of Baroda and State Bank of Travancore — to implement the scheme, M.K Lokesh, Indian Ambassador to the UAE, told

The banks have already approached the UAE Central Bank for necessary approval and the scheme will be launched soon, he said.

s Gulf News reported in July 2012, the Government of India planned to open a centre in Dubai to enrol thousands of Indian expatriate workers in its ambitious Pension and Life Insurance Fund (PLIF).

The voluntary scheme offering three important benefits will help skilled and unskilled workers to save money for their old age, to have financial means when they go back home and a life insurance cover for Rs100,000 (Dh6,600) during their work abroad.

About 65 per cent of more than two million Indians in the UAE are blue collar workers.

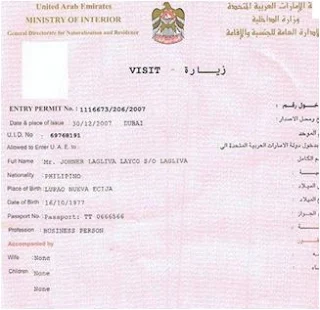

Workers between the age of 18 and 50 who hold Emigration Clearance Required (ECR) passports are eligible to enrol in the scheme. India issues ECR passports to those who have not passed a school leaving exam (Grade 10).

About 17,602 Indians availed of the recent amnesty declared by the UAE for illegal workers, the envoy said.

A total of 7,923 Indians left the UAE and 9,679 regularised their status according to figures given by the UAE authorities to the Indian Embassy.

Nearly 62,000 illegal workers had availed of the two-month-long amnesty from December 2, 2012 to February 2 this year according to the UAE authorities, which have not revealed nationality-wise figures of beneficiaries. More than 800,000 illegal residents availed of three similar amnesties between 1996 and 2007.

The embassy is still waiting for the approval from the UAE authorities to implement an online attestation of job contracts of Indian workers coming to the UAE , with Emigration Clearance Required – ECR category passports, he said. It will streamline the attestation of job contracts of ECR category workers by preventing fake contracts. The number of workers under ECR category coming to the UAE has witnessed a slight increase during the past four years, he said. Their number dropped from 349,000 in 2008 to 120,000 in 2009. Then it was 130,000 in 2010, 138,000 in 2011 and 141,000 in 2012, the envoy said.

Benefits:

Now the [Indian] ministry has engaged two Indian banks — Bank of Baroda and State Bank of Travancore — to implement the scheme, M.K Lokesh, Indian Ambassador to the UAE, told

The banks have already approached the UAE Central Bank for necessary approval and the scheme will be launched soon, he said.

s Gulf News reported in July 2012, the Government of India planned to open a centre in Dubai to enrol thousands of Indian expatriate workers in its ambitious Pension and Life Insurance Fund (PLIF).

The voluntary scheme offering three important benefits will help skilled and unskilled workers to save money for their old age, to have financial means when they go back home and a life insurance cover for Rs100,000 (Dh6,600) during their work abroad.

About 65 per cent of more than two million Indians in the UAE are blue collar workers.

Workers between the age of 18 and 50 who hold Emigration Clearance Required (ECR) passports are eligible to enrol in the scheme. India issues ECR passports to those who have not passed a school leaving exam (Grade 10).

About 17,602 Indians availed of the recent amnesty declared by the UAE for illegal workers, the envoy said.

A total of 7,923 Indians left the UAE and 9,679 regularised their status according to figures given by the UAE authorities to the Indian Embassy.

Nearly 62,000 illegal workers had availed of the two-month-long amnesty from December 2, 2012 to February 2 this year according to the UAE authorities, which have not revealed nationality-wise figures of beneficiaries. More than 800,000 illegal residents availed of three similar amnesties between 1996 and 2007.

The embassy is still waiting for the approval from the UAE authorities to implement an online attestation of job contracts of Indian workers coming to the UAE , with Emigration Clearance Required – ECR category passports, he said. It will streamline the attestation of job contracts of ECR category workers by preventing fake contracts. The number of workers under ECR category coming to the UAE has witnessed a slight increase during the past four years, he said. Their number dropped from 349,000 in 2008 to 120,000 in 2009. Then it was 130,000 in 2010, 138,000 in 2011 and 141,000 in 2012, the envoy said.

Benefits:

Workers joining the pension scheme will get three benefits – a lump sum amount from the resettlement and rehabilitation fund when they go back home, monthly old age pension after the age of 60 and a free of cost life insurance cover during their stay abroad.

The workers under Emigration Clearance Required category [those who have not passed matriculation] have to open a bank account and co-contribute a minimum Rs4,000 (Dh 244) per annum towards the resettlement and rehabilitation fund.

The Indian Government will provide a contribution of up to Rs2,000 (Dh132) per year for male workers and Rs3,000 (Dh198) per year for women workers for up to either five years or until the worker returns home, whichever is earlier.

A worker contributing a minimum of Rs4,000 (Dh 244) per annum for at least five years towards this fund, could get at least Rs30,000 (Dh1,980) after going back home, according to the Ministry of Overseas Indian Affairs. The money from the fund will be invested in mutual funds so the benefit may go up depending on the profits earned from mutual funds.

The old age pension fund requires a contribution of between Rs1,000 (Dh66) and Rs12,000 (Dh792) per annum. They will derive corresponding benefits when they go back home and during their old age.

The worker will get a monthly pension when he/she is 60 years old. The amount of monthly pension depends on the amount deposited in the pension fund. The worker will get at least 9 to 10 per cent profit based on current estimates.

In this case also, the benefit may go up in proportion to the profits from the mutual funds, according to the Indian ministry.

The workers under Emigration Clearance Required category [those who have not passed matriculation] have to open a bank account and co-contribute a minimum Rs4,000 (Dh 244) per annum towards the resettlement and rehabilitation fund.

The Indian Government will provide a contribution of up to Rs2,000 (Dh132) per year for male workers and Rs3,000 (Dh198) per year for women workers for up to either five years or until the worker returns home, whichever is earlier.

A worker contributing a minimum of Rs4,000 (Dh 244) per annum for at least five years towards this fund, could get at least Rs30,000 (Dh1,980) after going back home, according to the Ministry of Overseas Indian Affairs. The money from the fund will be invested in mutual funds so the benefit may go up depending on the profits earned from mutual funds.

The old age pension fund requires a contribution of between Rs1,000 (Dh66) and Rs12,000 (Dh792) per annum. They will derive corresponding benefits when they go back home and during their old age.

The worker will get a monthly pension when he/she is 60 years old. The amount of monthly pension depends on the amount deposited in the pension fund. The worker will get at least 9 to 10 per cent profit based on current estimates.

In this case also, the benefit may go up in proportion to the profits from the mutual funds, according to the Indian ministry.