The UAE economy is gradually recovering from the 2009

crisis. The banking sector was strengthened through significant capital

injections, and some progress has been made in restructuring the debt of

government-related entities (GRE). The ailing real estate sector is beginning

to find bottom but, given the ongoing oversupply, an early and broad-based

recovery of the sector remains unlikely.

Outlook and risks. The recovery of the nonhydrocarbon

economy, however, looks set to continue this year, backed by strong trade,

tourism, logistics, and manufacturing, and helped by high oil prices. With

limited near-term potential for further increases in real oil production, overall

GDP growth is expected to moderate to 2.3 percent. Downside risks relate to a

possible increase in regional geopolitical tensions, a potential decline in oil

prices, a renewed worsening of global financial conditions, or a marked

slowdown in Asia.

Macroeconomic policy mix. The UAE plans a gradual fiscal

consolidation this year which will help unwind the fiscal stimulus of recent

years and lower the currently high fiscal breakeven oil price without

undermining the economic recovery. The planned fiscal consolidation will also

increase the room for maneuver in case the downside risks materialize. Monetary

policy will stay appropriately accommodative under the U.S.dollar peg.

Government-related entities. The GREs continue to face

financial challenges in light of their high debt and rollover needs. Further

deleveraging and strengthening of impaired GRE balance sheets is needed.

Improving GRE corporate governance and increasing transparency about their

financing strategies, financial conditions, and debt profile would be important

to strengthen market confidence. Channeling bank funding to non-viable GREs

should be avoided.

Financial stability. The banking system maintains

significant buffers to withstand a further deterioration in asset quality and

external liquidity conditions. The central bank should nonetheless continue to

closely monitor banks’ liquidity and capital buffers as individual banks could

be affected if downside risks materialize.

Statistics. Effective policymaking is contingent on

timely and accurate data, rendering further improvements in the statistical

framework important

BACKGROUND

1. Following the 2009 crisis, the economy has been slowly

recovering and repairing its balance sheets. The Dubai World debt restructuring

was completed, but several other troubled government-related entities (GRE) are

still in the process of restructuring. The authorities strengthened the banking

sector through liquidity support, recapitalization, and deposit guarantees, and

the emirate of Abu Dhabi provided financial support to the emirate of Dubai.

The Dubai Financial Support Fund (DFSF) was called to support troubled entities

in the emirate and has now almost exhausted its funding of $20 billion.

2. The UAE has been reaping the benefits of its early

efforts to diversify the economy. As the UAE developed into a major services

hub in the Middle East, its dependency on oil exports declined markedly.

Based on its well-developed hospitality and services

sectors, tourism, transportation and logistics have been major drivers of the

post- 2009 recovery. The UAE has also been benefiting from high oil prices and

strong growth in Asia. As a result of its perceived safe haven status and

developed services sector, the country benefited from an increase in demand for

property by expatriates and a

surge in tourism in the wake of the turmoil in the MENA

region that began last year.

Recent Developments

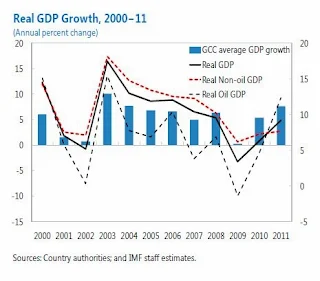

3. The economic recovery continued and the external

position strengthened significantly in 2011. Real GDP growth reached an

estimated 4.9 percent, supported by high oil prices and production in response

to disruptions in Libya. Nonhydrocarbon growth also strengthened, to around 2.7

percent, backed by strong trade, logistics and a surging tourism sector,

despite the continued weakness of the construction and real estate sectors in

the aftermath of the 2009 crisis. Backed by high oil prices and buoyant

Nonhydrocarbon exports, the external current account surplus increased

markedly, to around 9 percent of GDP. Inflation remained subdued at an average

of 0.9 percent in 2011, mainly due to a continuing decline in housing rents and

limited pass-through of international food prices.

4. The large property overhang continues to be a drag on

the economy. Since mid-2008, real estate prices have fallen by more than 60

percent in Dubai, and to a lesser extent in Abu Dhabi. The large supply

overhang and the completion of additional projects in the coming years render

an early and broad-based recovery of the sector unlikely (Box 1).increased its

current and development expenditures, and extended substantial financial

support to Aldar, its flagship real estate developer.2 Following a contraction

in 2010, Dubai’s deficit increased slightly in 2011, mostly on account of

further spending from the DFSF. Nonetheless, high oil prices led to an improvement

in the consolidated overall balance from a deficit of 2.1 percent of GDP in 2010

to an estimated surplus of 2.9 percent of GDP in 2011.

5. The recovery

was supported by an expansionary fiscal policy. The consolidated government

nonhydrocarbon primary deficit (including loans and equity) rose to nearly 42

percent of nonhydrocarbon GDP in 2011 (from 36 percent in 2010), as Abu Dhabi increased

its current and development expenditures, and extended substantial financial

support to Aldar, its flagship real estate developer.2 Following a contraction

in 2010, Dubai’s deficit increased slightly in 2011, mostly on account of

further spending from the DFSF. Nonetheless, high oil prices led to an improvement

in the consolidated overall balance from a deficit of 2.1 percent of GDP in 2010

to an estimated surplus of 2.9 percent of GDP in 2011.

6. Supported by accommodative monetary policy, banks

remained amply liquid but private sector credit growth did not pick up. In

light of low U.S. interest rates, monetary policy stayed accommodative under the

fixed exchange rate regime. Lending to the private sector has nonetheless

remained sluggish and lagged behind the recovery in credit growth in

neighboring GCC countries, as

excess capacity in the real estate sector and the debt

overhang still limit lending opportunities. Despite a continued rise in nonperforming

loans (second highest level among GCC countries), the banking sector has remained

well-capitalized and profitable, as the net interest margin has remained

comfortable. In October 2011, the authorities quickly

resolved Dubai Bank through a takeover by Emirates NBD bank

1 The Dubai Financial

Support Fund, financed in equal parts by the central bank and Abu Dhabi, was established

in 2009 to provide financial support and liquidity to government and

government-related entities undertaking projects of strategic importance in Dubai.

2 The consolidated

government comprises the federal, Abu Dhabi, Dubai, and Sharjah governments accounting

for over 99 percent of total UAE fiscal expenditures.

3 In connection with this

transaction, Emirates NBD received a Dh2.8 billion deposit from the ministry of

finance. The government of Dubai has provided a guarantee—with a fair value of

Dh768 million—for any losses relating to existing assets for seven years.

1 comment:

SA Rawther Spices is the largest processor and exporter of black pepper and dry ginger in India, apart from having a good track record in the international trade of coffee, turmeric, cloves, chillies, nutmeg and other products.

TURMERIC

Botanical names: Curcuma longa

Family name: Zingiberaceae

Turmeric “the golden spice of life” is one of most essential spice used as an important ingredient in culinary all over the world. Turmeric, basically a tropical plant of ginger family is the rhizome or underground stem, with a rough, segmented skin. A yellow spice with a warm and mellow flavor, it is mildly aromatic and has scents of orange or ginger.

FOR MORE DETAILS VISIT : http://rawther.co.in/

Post a Comment